Whenever I dive into Altcoins metrics, one number always grabs my attention: TVL (Total Value Locked). To me, TVL is like a scoreboard; it shows where the money is flowing and which blockchains are earning the trust of users. If liquidity is the lifeblood of decentralized finance, then TVL is the pulse you check first.

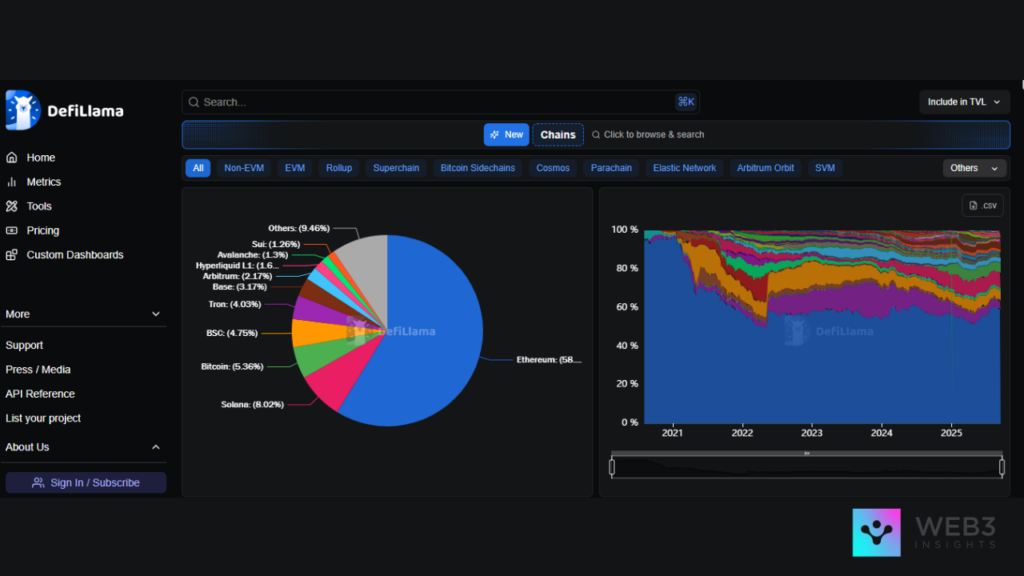

And right now, three chains are standing head and shoulders above the rest: Ethereum, Solana, and Bitcoin. Let’s break down why these three altcoins are dominating the DeFi market today, what makes them special, and why I believe they’ll continue shaping the financial layer of crypto in 2025.

Why TVL Matters for Altcoins

If you’re new to tracking Altcoins, let me explain TVL in simple terms. TVL measures the total amount of crypto locked in decentralized applications (dApps). This includes lending protocols like Aave, staking platforms like Lido, and decentralized exchanges like Uniswap or Raydium.

When TVL is high, it means people are confident enough in a blockchain’s ecosystem to deposit their funds, whether for staking, lending, or trading. It signals both adoption and liquidity. And the truth is, without liquidity, DeFi simply doesn’t work.

What I love about TVL is that it’s not just a vanity metric, it reflects real usage. If Ethereum has billions locked in lending protocols, it means institutions, whales, and everyday traders are trusting that chain with their assets. When Solana’s TVL shoots up, you know it’s not just hype; it’s actual users locking in their funds.

So, which altcoins are sitting at the top right now?

1. Ethereum (ETH)

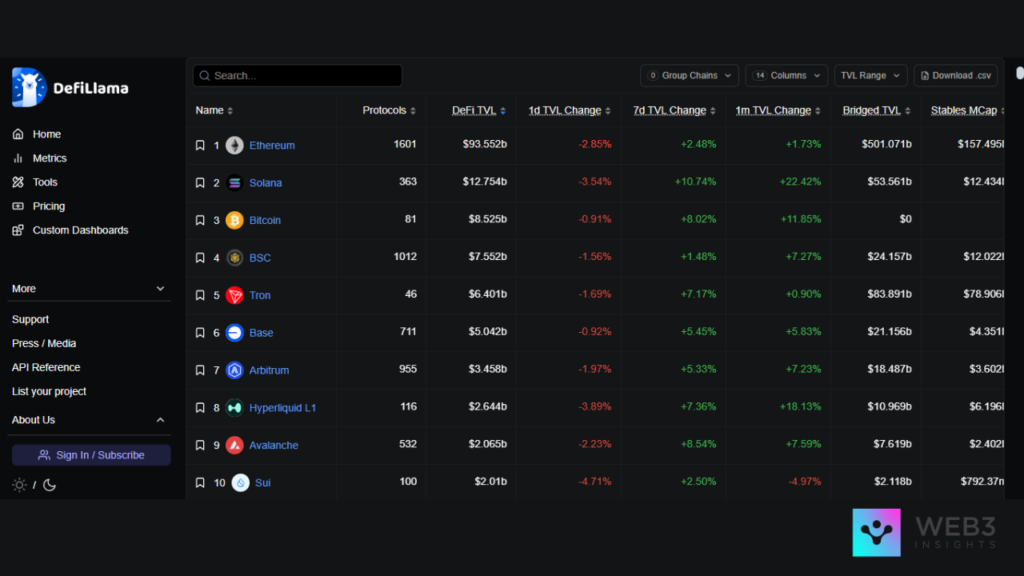

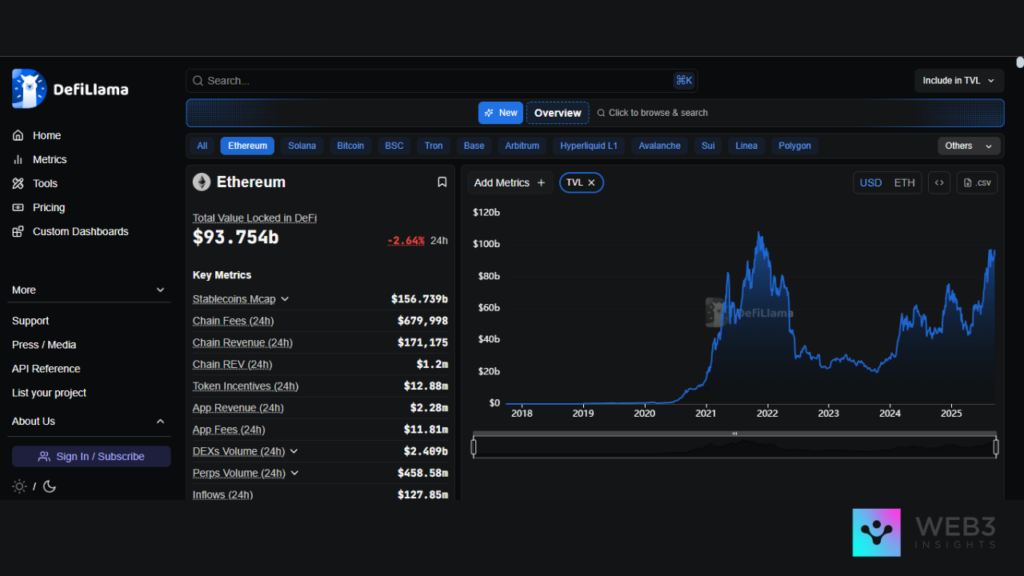

It’s no surprise that Ethereum still leads DeFi by a wide margin. With nearly $94 billion in TVL, it controls the largest share of liquidity across all blockchains. For context, that’s more than 7 times larger than Solana’s DeFi ecosystem and over 10 times bigger than Bitcoin’s current footprint.

Why does Ethereum dominate? It’s all about first-mover advantage and network effects. Most of the early DeFi innovations were built on Ethereum: MakerDAO’s decentralized stablecoin DAI, Aave’s lending pools, Uniswap’s automated market maker. These weren’t just products; they became the blueprint for all of DeFi.

Ethereum is also the backbone for stablecoins. USDC, DAI, and USDT all rely heavily on Ethereum’s infrastructure. That’s billions of dollars in liquidity flowing through ETH-based protocols every single day.

And then there’s staking. Lido Finance, Ethereum’s biggest liquid staking platform, alone accounts for more than $20 billion in locked ETH. Add in Aave, Curve, and MakerDAO, and you start to see why Ethereum is still the king of DeFi.

Personally, I see Ethereum as the “Wall Street” of crypto. It’s slower and more expensive than newer chains, sure, but it has the deepest liquidity, the most institutional trust, and the richest ecosystem of developers. Whenever I want to gauge the health of DeFi as a whole, I always start by checking Ethereum’s TVL chart on DefiLlama.

2. Solana (SOL)

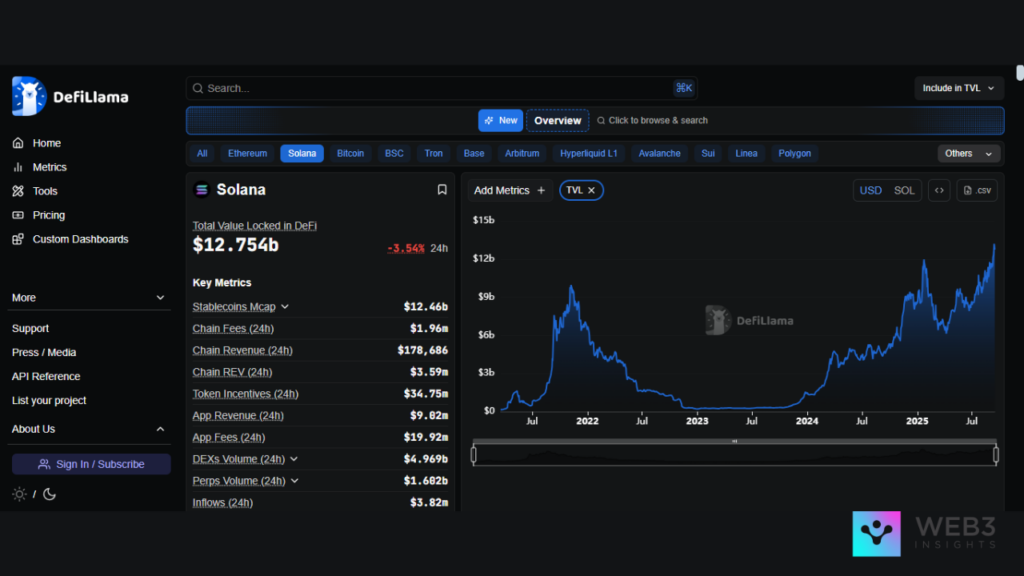

Now, here’s where things get exciting. Solana has quietly climbed to the #2 spot in DeFi, with about $12.7 billion in TVL. Just a couple of years ago, Solana was seen as an “Ethereum alternative” that couldn’t quite break through. But today, it’s proven that it’s more than just an alternative, it’s a true contender.

What’s driving Solana’s growth? For one, liquid staking protocols like Jito and Marinade have exploded in popularity. People want to stake their SOL, but they also want to keep their assets liquid and usable in DeFi. That’s exactly what these platforms offer.

Another factor is NFT-Fi (NFTs integrated with DeFi). Solana already had one of the strongest NFT communities, and now projects are layering financial tools on top of NFTs, things like collateralized lending or NFT-backed liquidity pools. It’s a blend of culture and finance that Ethereum pioneered but Solana perfected for retail users.

And let’s not forget fees and speed. Solana is cheap and fast. That’s a huge deal for retail users and DeFi traders who don’t want to pay $50 just to swap tokens. For me, using Solana always feels effortless compared to Ethereum. And I think that’s why its adoption is skyrocketing.

When I look at Solana’s TVL chart on DefiLlama, I see something Ethereum doesn’t have anymore: momentum. Solana might not catch up to Ethereum anytime soon, but it’s carving out its own space as the retail-friendly DeFi hub of crypto.

3. Bitcoin (BTC)

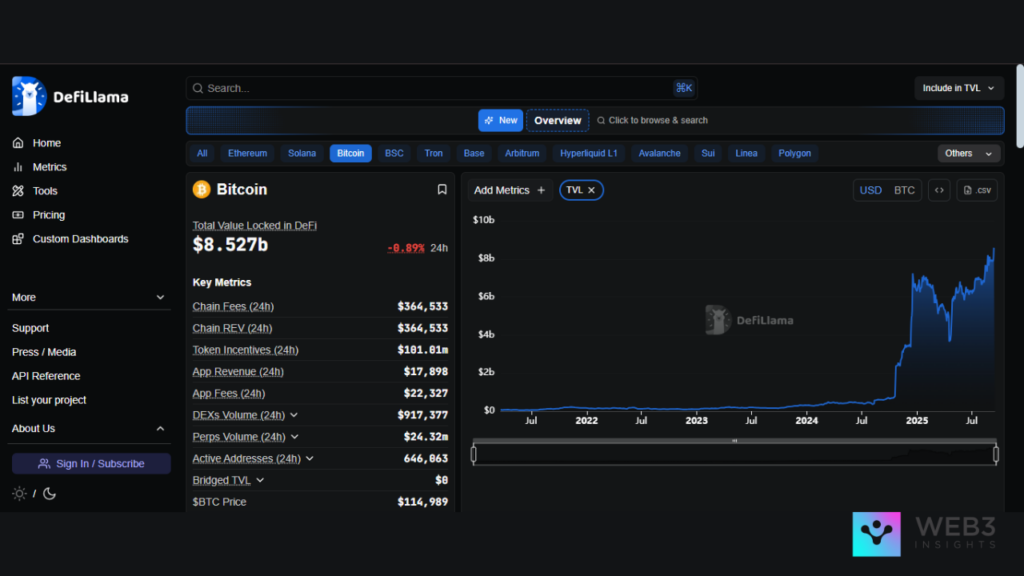

This is the part that still blows my mind. Bitcoin now has over $8.5 billion in DeFi TVL. For the longest time, Bitcoin was considered outside the DeFi conversation. It was “digital gold”, a store of value, not a chain for apps or liquidity.

But things have changed. With the rise of Bitcoin Layer-2s and protocols like Runes and Stacks, BTC is becoming more versatile. People are now locking their Bitcoin into DeFi protocols, earning yield, and even participating in lending and trading.

There’s also the trend of wrapped Bitcoin (wBTC) being used on Ethereum and other chains. This bridges Bitcoin into DeFi ecosystems it wasn’t originally designed for. In other words, BTC is finally learning how to play the DeFi game, and investors are responding.

What excites me most about Bitcoin’s DeFi growth is the legitimacy it brings. If the most “conservative” crypto asset in the world is making its way into DeFi, then the sector is officially mainstream.

Honestly, I never thought I’d see Bitcoin in the same conversation as Ethereum and Solana for DeFi dominance. Yet here we are in 2025, with BTC holding down the #3 spot on DefiLlama.

Conclusion

DeFi is no longer just a niche, it’s the core of crypto’s financial system. And when you look at the numbers, there’s no denying who’s running the show right now: Ethereum, Solana, and Bitcoin.

Every time I refresh DefiLlama and see their TVL charts, I’m reminded of how fast things change in this space. A few years ago, Solana wasn’t even close to Ethereum. Bitcoin wasn’t even in the conversation. Now, they’re both in the top 3.

If you’re serious about tracking altcoins and the broader crypto market, these three should be on your radar every single day. Watch their TVL, follow their top protocols, and you’ll always have a clear picture of where DeFi is heading.

Because in the end, the chains that dominate TVL are the chains that dominate DeFi. And right now, Ethereum, Solana, and Bitcoin are the ones holding the crown.