Altcoins have always been the heartbeat of the crypto market. While Bitcoin sets the overall tone, it’s Altcoins that deliver the explosive moves that turn small investments into life-changing gains. The real challenge for investors is figuring out which Altcoins are poised to rally before the rest of the market catches on. Charts and price action can only tell you so much; they’re a reflection of the past. The real edge comes from looking beneath the surface, at what’s happening on-chain. On-chain data reveals how a network is being used in real time: who is transacting, how much value is flowing, and whether demand is quietly building up. When on-chain signals light up before a pump, they can give you a powerful head start.

In this post, we’ll explore exactly how to spot Altcoins with strong on-chain activity before they break out, the metrics that matter most, and the tools you need to track them effectively.

Why On-Chain Activity Matters for Altcoins

On-chain activity is essentially the “heartbeat” of a blockchain. It reflects how alive and active a network is at any given time. For Altcoins, which often compete with thousands of other tokens, consistent network activity separates serious projects from speculative noise.

For example, if an Altcoin claims to be powering decentralized finance (DeFi) or NFT platforms, then its on-chain data should reflect it. We should see transactions increasing, wallet addresses growing, and liquidity flowing into smart contracts. If these metrics are trending up while the price hasn’t yet moved dramatically, it can signal early-stage demand that often precedes a breakout rally.

Put simply: price follows activity. By tracking Altcoin networks directly, you can spot genuine adoption long before it shows up in market charts.

Key On-Chain Metrics to Watch

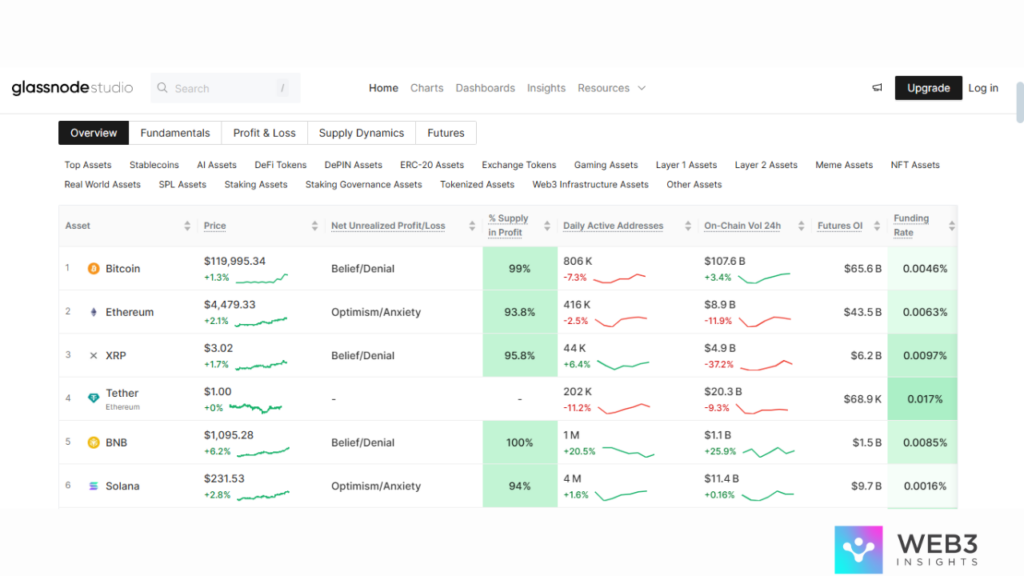

1. Active Wallet Addresses

One of the clearest signals of growth in any Altcoin ecosystem is the number of active wallet addresses. An increase here shows that more people are transacting with the token, not just holding it. For example, when Polygon (MATIC) wallet activity surged in early 2021 due to its rising role in scaling Ethereum, its price followed soon after.

- What to watch: A steady upward trend in unique daily or weekly active wallets.

- Why it matters: Suggests organic adoption, not just short-term speculation.

2. Transaction Volume and Value Transferred

Rising transaction volume, especially when paired with higher transaction value, is a strong sign of real network usage. If an Altcoin is suddenly moving millions of dollars’ worth of tokens per day when it was previously barely active, whales or institutions may be positioning themselves early.

- What to watch: Spikes in transaction value that are sustained for weeks, not just days.

- Why it matters: High-value transactions often indicate confidence from larger investors.

3. Network Fees and Gas Usage

If people are willing to pay higher fees just to use a blockchain, it signals demand. This is what we saw during Ethereum’s DeFi summer in 2020: network fees skyrocketed as users rushed to participate in yield farming and liquidity pools. For Altcoins, a sudden rise in fees or block space usage can point to increasing activity in their ecosystem.

- What to watch: Rising fee revenue for validators or miners.

- Why it matters: Shows users see enough value to compete for network space.

4. Staking, Lockups, and DeFi Activity

When Altcoin holders stake tokens or lock them in smart contracts, it reduces the liquid supply on exchanges. If demand increases at the same time, this creates scarcity and upward price pressure. For example, Solana’s TVL growth in DeFi protocols signalled strong adoption before its 2021 rally.

- What to watch: Growth in staking ratios and total value locked (TVL).

- Why it matters: Locked supply means less selling pressure, magnifying price pumps.

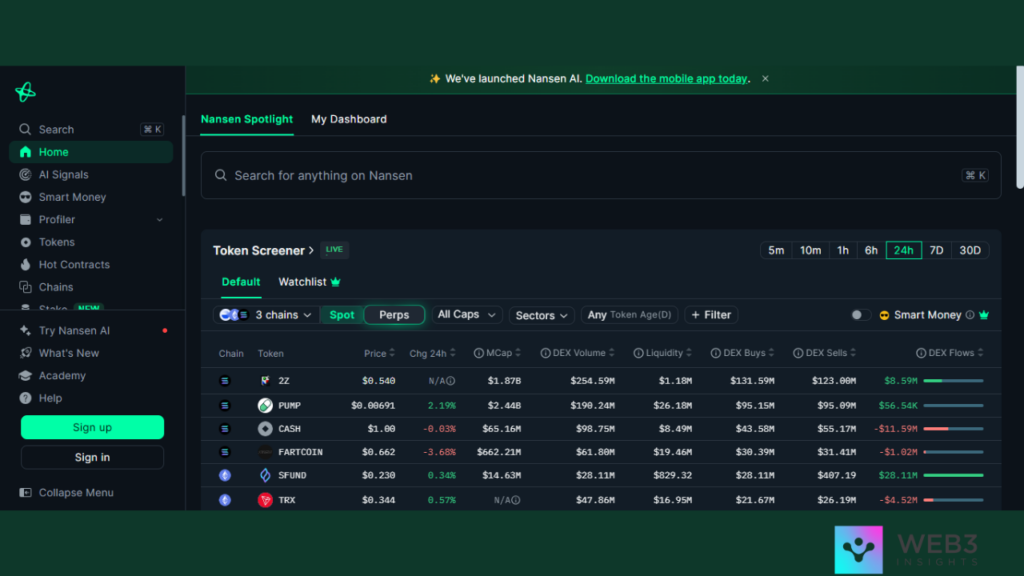

5. Whale Transactions and Token Flows

Large wallets often move before the crowd. By tracking whale activity, you can sometimes spot an accumulation before a pump. If several large wallets are accumulating an Altcoin while on-chain activity rises, it’s a strong bullish signal.

- What to watch: Sudden whale wallet inflows or on-chain accumulation.

- Why it matters: Smart money often positions before retail investors catch on.

Practical Strategy: How to Apply This as an Investor

Spotting Altcoins early requires connecting signals from multiple metrics rather than relying on just one. Here’s how to build a practical approach:

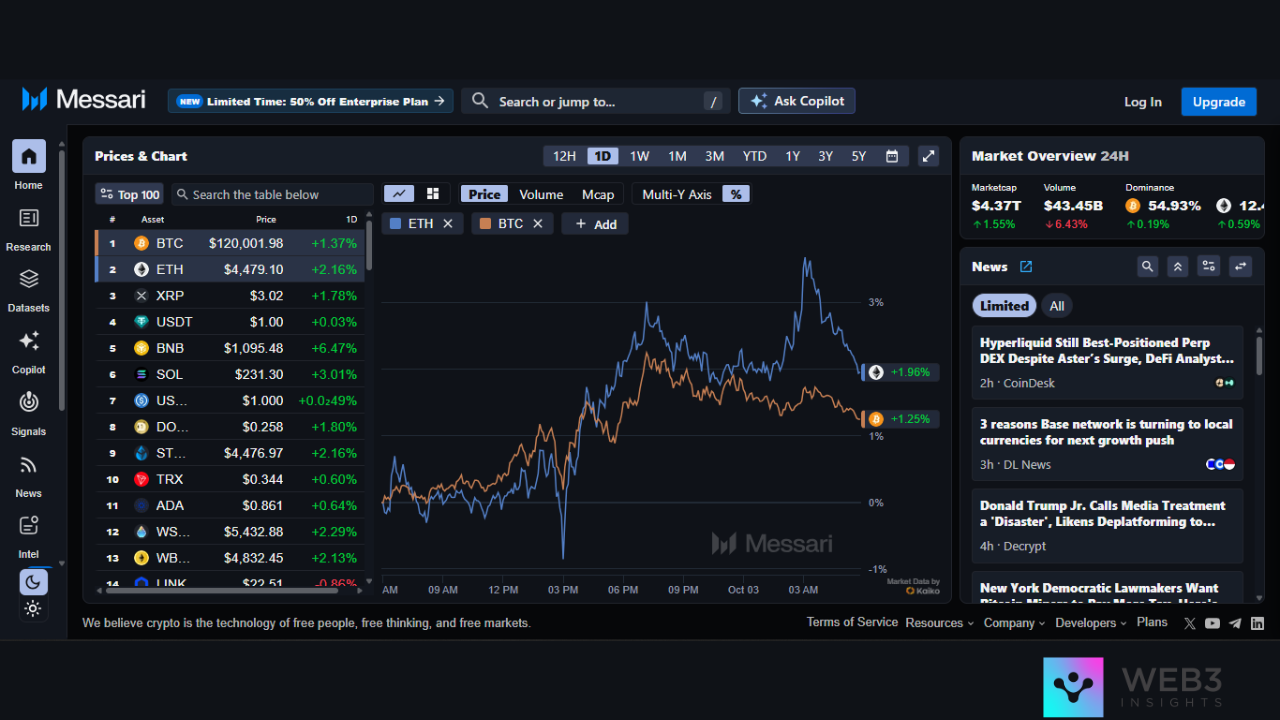

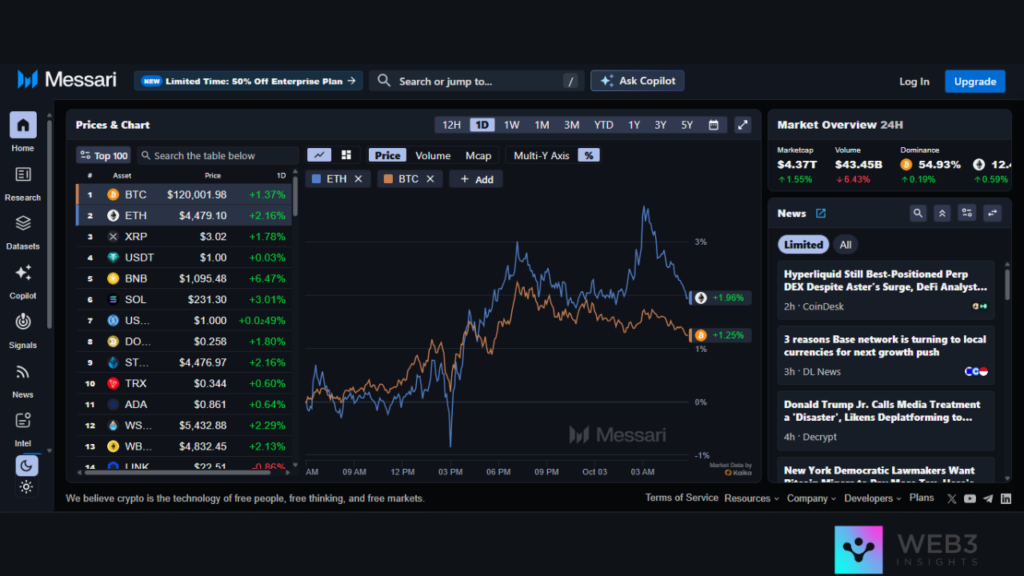

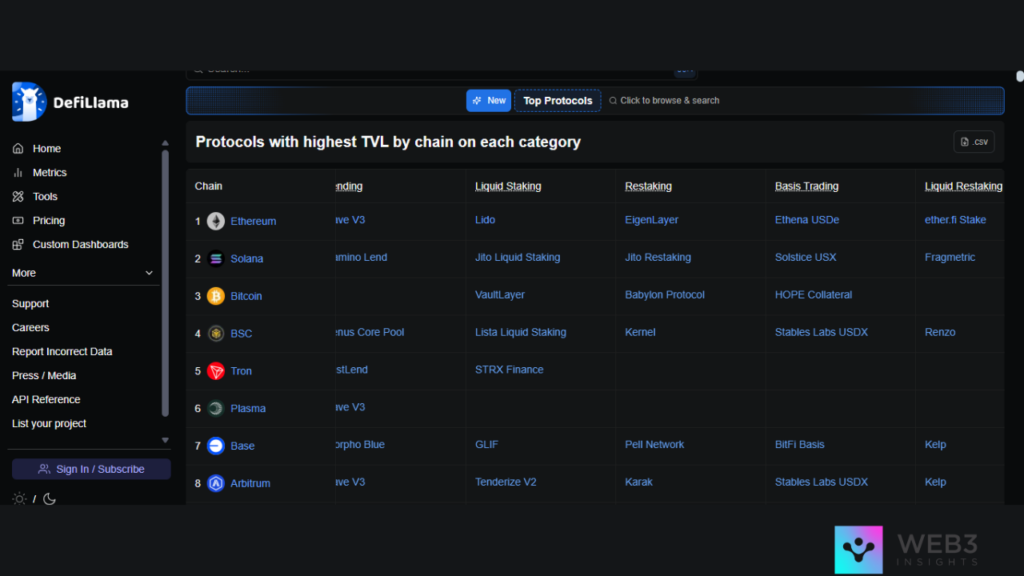

- Screen Broadly: Use tools like DefiLlama or Nansen to scan for Altcoins showing spikes in wallet addresses or TVL. Create watchlists of coins that are seeing unusual growth.

- Filter by Quality: Rule out coins that only show one-off transaction spikes (which may be manipulation. Focus on Altcoins with consistent upward trends across at least two or three metrics.

- Watch Whale Activity: If whale wallets are accumulating, it signals confidence. Combine this with rising small wallet activity for a strong confirmation signal.

- Time Your Entry With Market Sentiment: Use on-chain data to confirm strong Altcoin fundamentals. Pair it with technical analysis and social sentiment (is hype starting to build?) to refine entry points.

- Stay Ahead With Alerts: Many tools allow you to set custom alerts for sudden on-chain shifts. This way, you’re not reacting late; you’re catching the pump before retail arrives.

If two or three of these align, you may be looking at an Altcoin that’s primed for a pump. Combine this with technical analysis (to time entries) and market sentiment (to gauge hype cycles), and you have a stronger edge.

Final Thoughts

Altcoins remain one of the most exciting corners of crypto, offering both huge potential rewards and significant risks. By focusing on on-chain activity, you can cut through the noise and spot which projects are gaining real traction before their price charts reflect it.

In the end, the formula is simple: activity precedes price. If you’re consistently monitoring wallet growth, transaction volume, staking levels, and whale moves, you’ll position yourself ahead of retail traders chasing green candles.

The investors who win big in Altcoins are not the ones who follow the crowd, but the ones who learn to see the signals before the crowd arrives, and on-chain data is the clearest signal of all.