When we talk about crypto markets in 2025, the spotlight isn’t just on Bitcoin, it’s also on altcoins, the broader ecosystem of tokens that drive liquidity, innovation, and investor excitement. One of the clearest ways to understand where the market is heading is by looking at trading volume. Volumes tell us where the action is, where traders are putting their money, and which coins are leading the charge.

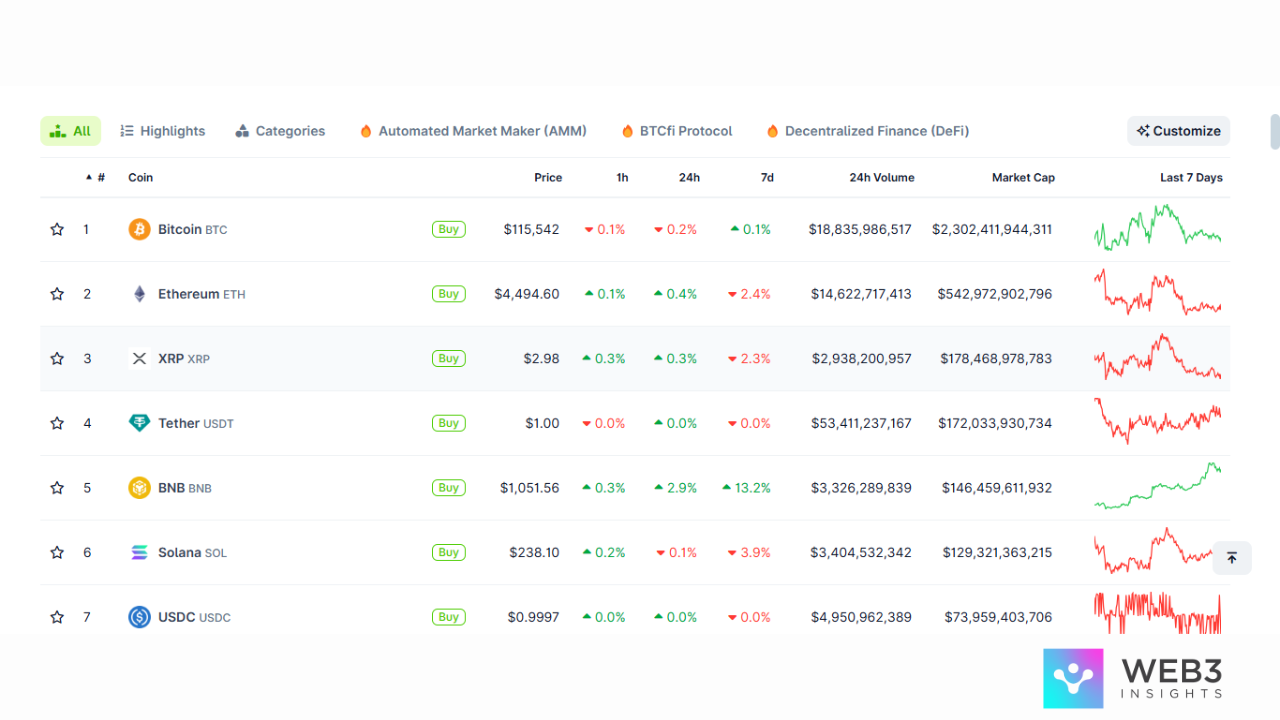

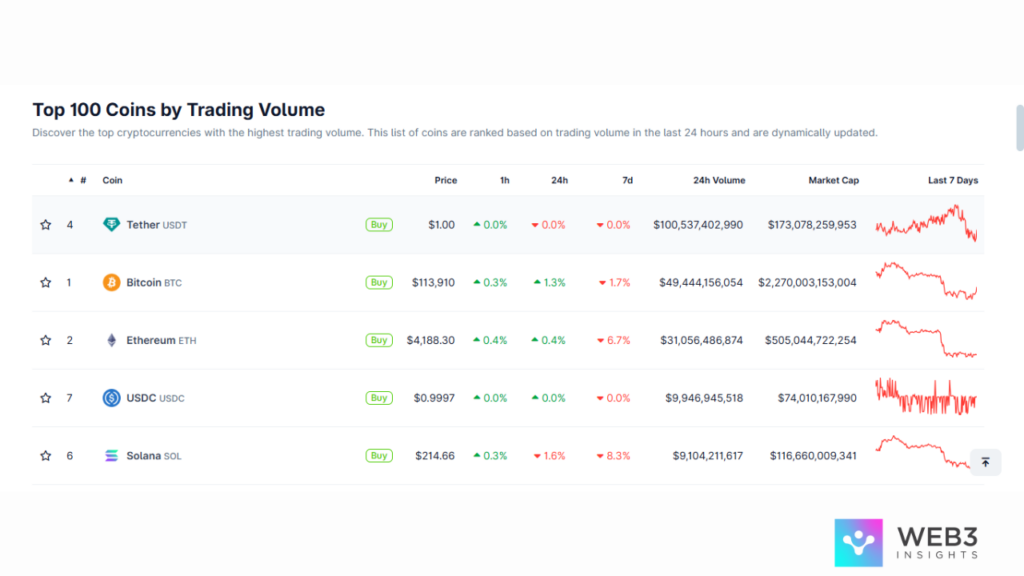

In 2025, trading activity has been especially telling. With ETFs rolling out, stablecoins becoming the backbone of global crypto liquidity, and altchains like Solana catching fire, the top 5 most-traded coins say a lot about where the market is heading. Based on live data I pulled from CoinGecko (screenshot included), here are the assets with the biggest trading volume spikes right now: Tether (USDT), Bitcoin (BTC), Ethereum (ETH), USD Coin (USDC), and Solana (SOL).

Let me walk you through why each of these coins is dominating the charts, and what it really means.

1. Tether (USDT): The Liquidity King of Altcoins

If crypto had a heartbeat, it would probably be Tether. No matter what market cycle we’re in, Tether’s trading volume always seems to be on top. And honestly, I’m not surprised. Whenever I trade altcoins, most of the pairs are denominated in USDT. It’s the default currency of crypto trading.

What stands out in 2025 is just how massive USDT volumes have become. Every day, tens of billions of dollars move through Tether. It’s the token traders use to exit Bitcoin into safety, the one they use to rotate between memecoins, and the one exchanges prefer to list with almost every alt.

Some people look at Tether and say, “But it doesn’t go up, so why care?” For me, that’s missing the point. Tether isn’t about price action; it’s about liquidity. And when USDT’s volumes spike, it means traders are moving in and out of positions aggressively. In other words, the market is buzzing.

Takeaway: Whenever I see USDT trading volume climbing, I know altcoin speculation is heating up in the background.

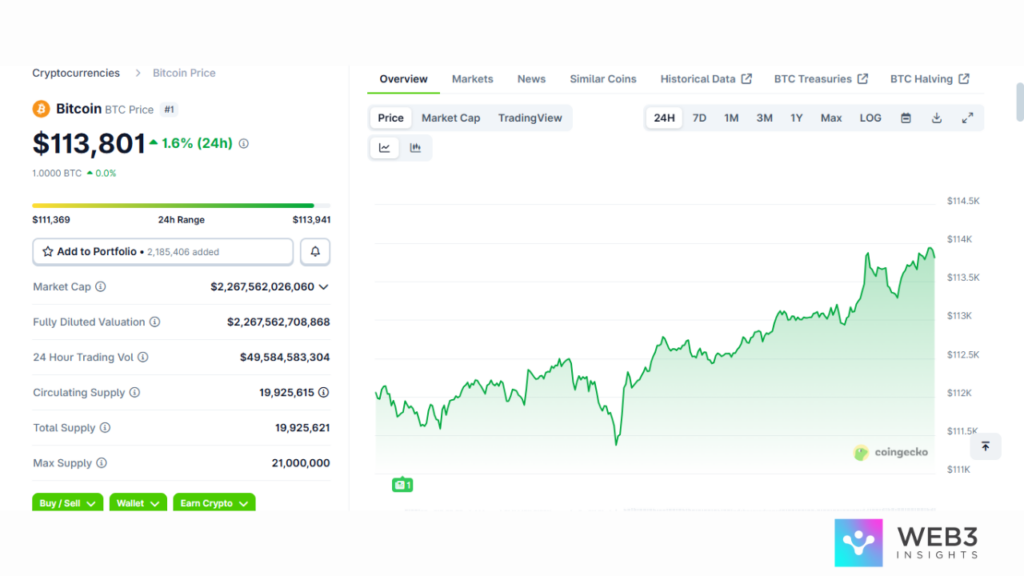

2. Bitcoin (BTC): Setting the Tone for Altcoins

Even though this post is about altcoins, there’s no way to ignore Bitcoin’s role. Bitcoin’s trading volumes in 2025 have been nothing short of incredible. With multiple spot ETFs launched in the U.S. and Asia, BTC isn’t just a “crypto coin” anymore, it’s becoming a mainstream asset.

I noticed this year that whenever ETF inflows spike, Bitcoin volumes on exchanges follow almost instantly. Retail traders are also back in force, chasing dips and piling in when momentum picks up. What makes BTC’s volume story so fascinating to me is that it often acts like a signal for the rest of the market.

Here’s what I mean: when Bitcoin trading volumes are high, it usually gives confidence to altcoin traders. It’s like the big brother of the market saying, “Okay, it’s safe to play now.” And when BTC volumes dry up, the altcoin party often cools down too.

Takeaway: Bitcoin may not have the wildest pumps anymore, but its trading volume is still the clearest indicator of whether the entire crypto market is risk-on or risk-off.

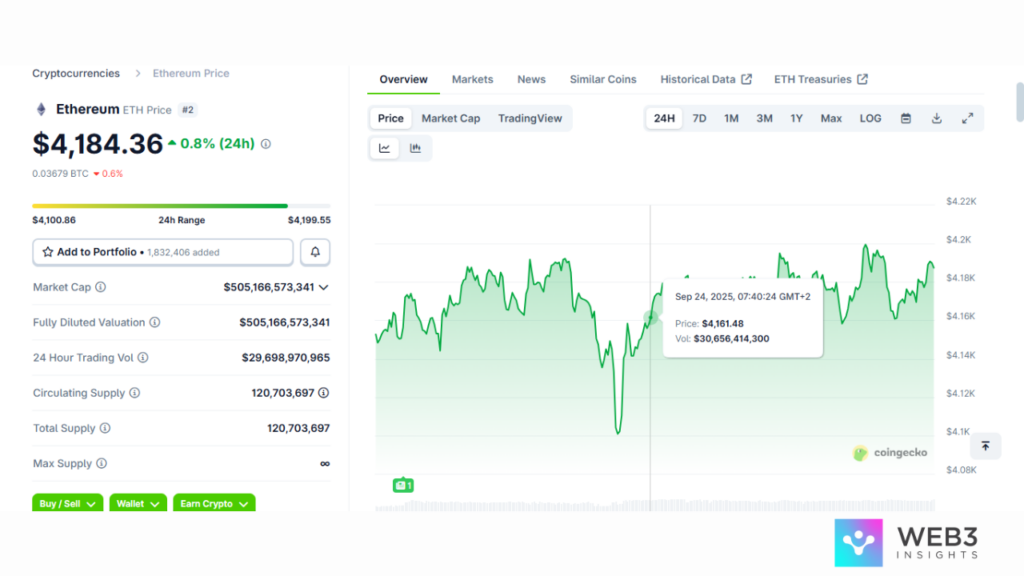

3. Ethereum (ETH): The DeFi Backbone of Altcoins

I have a soft spot for Ethereum because every time I check DeFi activity or NFTs, ETH is right at the center. In 2025, Ethereum’s volumes are still consistently top-tier, and I think that says something powerful: even with Solana and other fast chains gaining traction, Ethereum remains the backbone of Web3.

One of the biggest drivers of ETH volume spikes this year has been the rollouts of new scaling upgrades like proto-danksharding. Lower fees made it easier for users to come back into Ethereum-based DeFi apps. I also noticed NFT activity picking up again, and guess what? Most of the high-value projects are still being minted on ETH.

What I love about Ethereum’s volume story is that it isn’t just traders speculating, it’s developers, institutions, and retail all transacting on the same chain. That mix of real utility plus speculation is what keeps ETH at the top.

Takeaway: ETH trading volume is like a thermometer for the health of DeFi and NFTs. When ETH is active, the broader altcoin ecosystem is thriving.

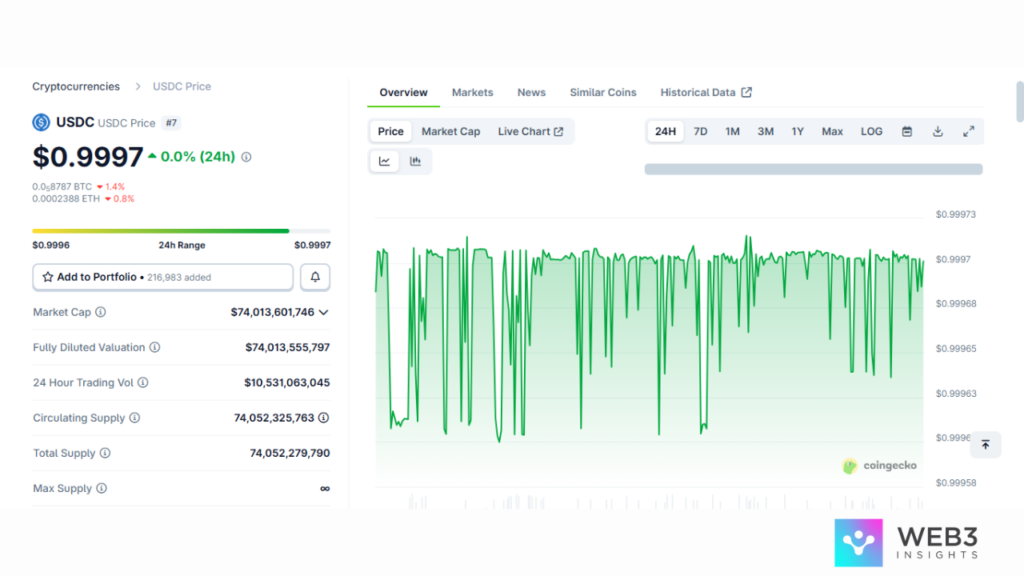

4. USD Coin (USDC): Powering Altcoin Liquidity

If Tether is the wild, free-market stablecoin, then USDC is its polished, regulated cousin. In 2025, USDC’s trading volumes have been consistently massive, and that’s because it has quietly become the preferred stablecoin for institutions.

What stood out to me this year is how often USDC shows up in ETF settlement structures, regulated DeFi protocols, and even corporate treasuries. Volumes spike whenever big trading desks rebalance or whenever USDC flows into new DeFi products. It’s the stablecoin that big money actually trusts.

For regular traders like me, that’s reassuring. It tells me that stablecoins aren’t just about moving between altcoin trades; they’re becoming the financial plumbing of a new, hybrid crypto-traditional system.

Takeaway: High USDC volumes show us where the regulated money is flowing. If Tether tells me what retail traders are doing, USDC tells me what institutions are betting on.

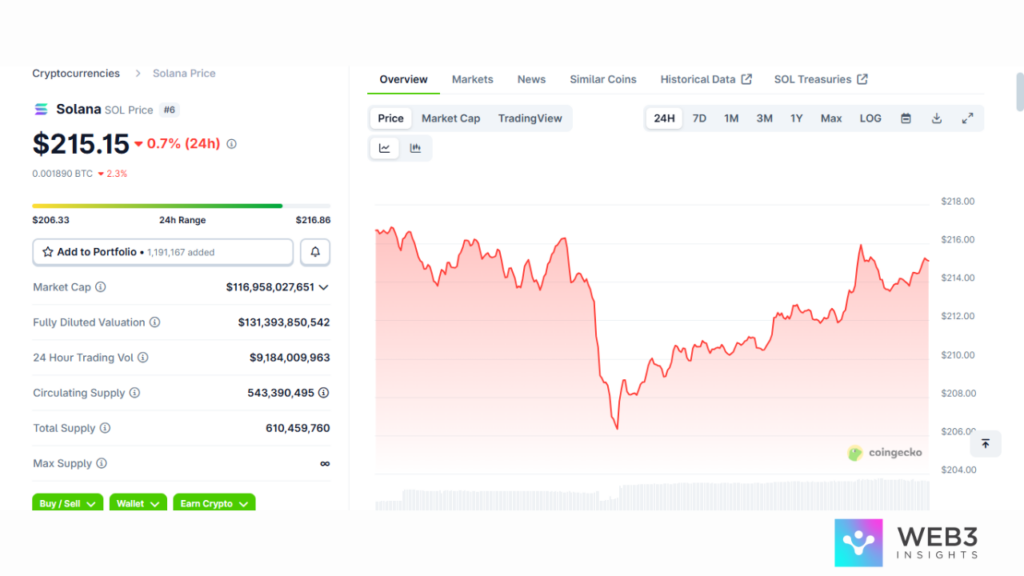

5. Solana (SOL): The Retail Darling of Altcoins

Finally, we have Solana, and honestly, this one excites me the most. Solana’s trading volumes in 2025 have been skyrocketing, and every time I dig into why, it usually comes back to one thing: retail traders love Solana.

This year, I’ve seen volume spikes tied to memecoin seasons, DeFi farming on Solana apps, and even major retail integrations. Payments on Shopify and Visa using Solana-based USDC? That’s huge. Combine that with lightning-fast speeds and dirt-cheap fees, and it’s no wonder Solana has become a volume powerhouse.

What makes Solana so unique is the culture around it. Unlike Ethereum, which leans more institutional, Solana feels like the chain where the everyday trader hangs out. When I see Solana volumes rising, I know there’s hype, speculation, and genuine community energy behind it.

Takeaway: SOL trading volume is my favorite indicator of retail appetite. If Solana’s hot, the market mood is probably bullish.

Wrapping It Up

Examining trading volumes in 2025 presents a clear picture. The assets with the highest spikes aren’t just random coins; they’re the pillars of crypto liquidity:

- Stablecoins (USDT, USDC) keep the system running.

- Bitcoin (BTC) drives overall sentiment.

- Ethereum (ETH) anchors DeFi and NFTs.

- Solana (SOL) channels retail energy and new narratives.

For me, this balance between stability, infrastructure, and speculation is what makes the current cycle so fascinating. And it’s also why I pay such close attention to volumes, because they reveal where the real money is flowing, long before the headlines catch up.

So the next time you see a spike in CoinGecko’s trading volume charts, don’t ignore it. That’s where the story starts.