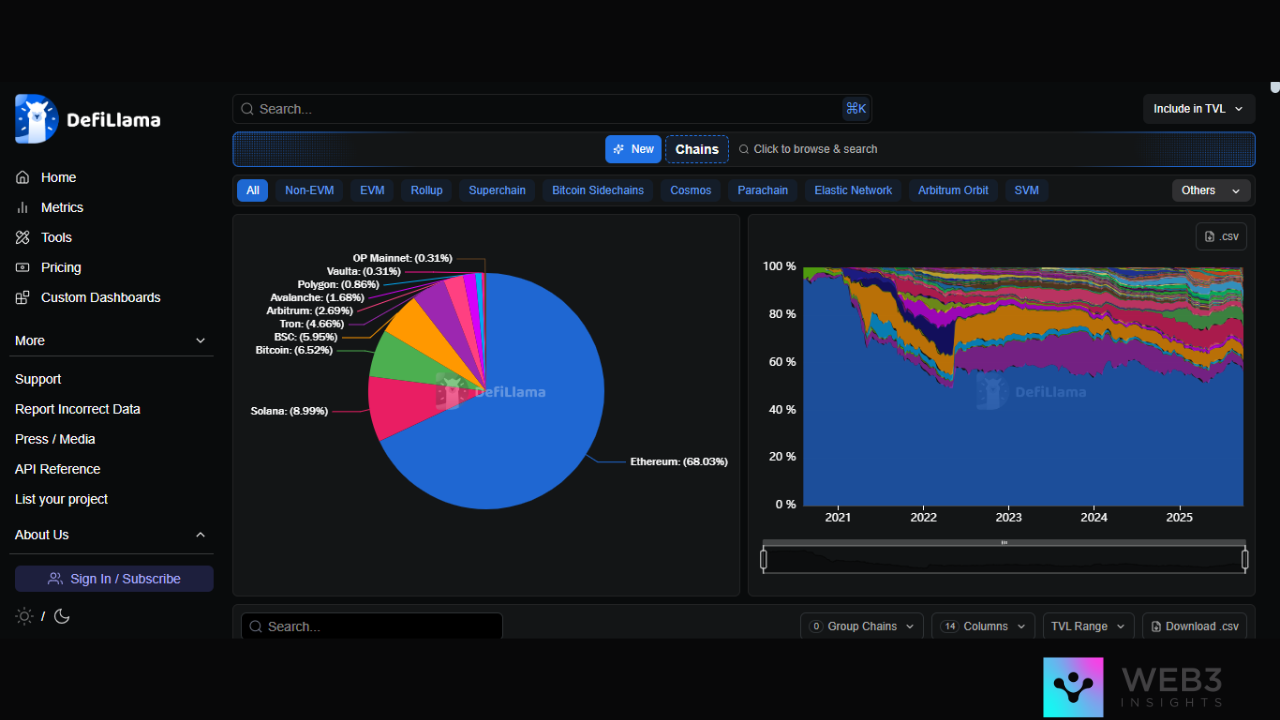

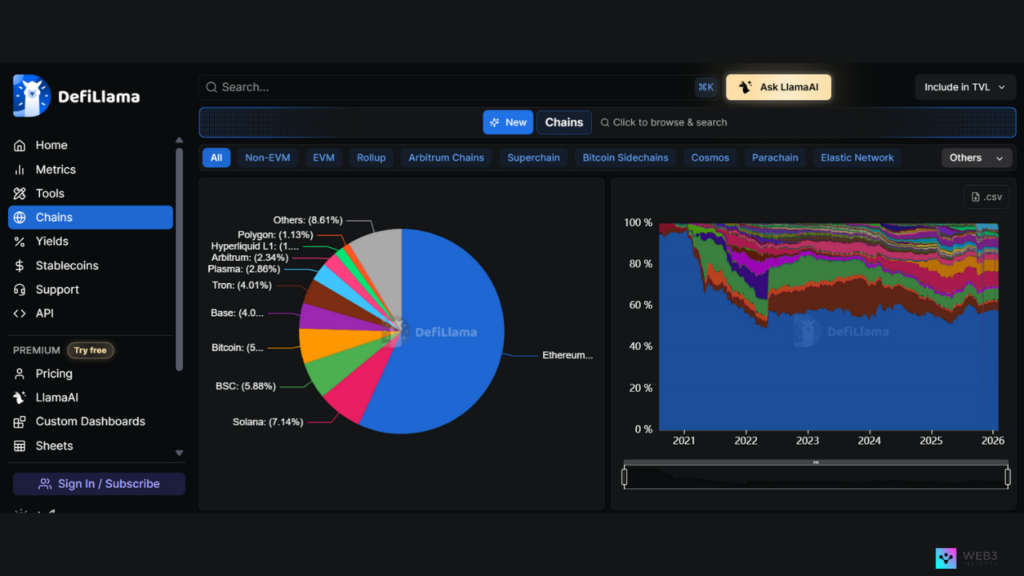

If there’s one thing I’ve learned from following the crypto markets, it’s that altcoins are no longer just side players to Bitcoin. In 2026, they’ve become the lifeblood of decentralized finance (DeFi), powering lending platforms, staking pools, and liquidity hubs that keep this new financial system alive. But how do we measure which altcoins are really leading the pack? That’s where Total Value Locked (TVL) comes in.

TVL tracks the total amount of money, whether in ETH, stablecoins, wrapped BTC, or other tokens that users have deposited into DeFi protocols. It’s not just a speculative metric; it reflects genuine user trust and adoption. The higher the TVL, the more users are putting their assets to work on that chain. And right now, five altcoins stand out above all the rest when it comes to dominating DeFi by TVL. Let’s dive into the leaders.

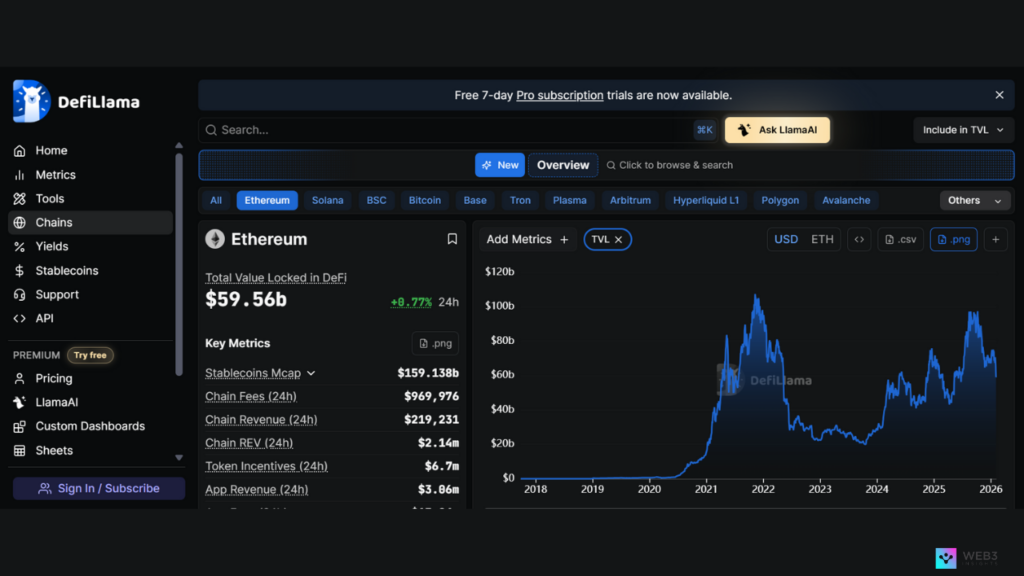

1. Ethereum (ETH): $59.56B Locked

Ethereum is still the undisputed king of DeFi, with nearly $60 billion locked across its ecosystem. From lending protocols like Aave to liquid staking on Lido and stablecoin issuance via MakerDAO, Ethereum continues to be the beating heart of decentralized finance.

Even though Ethereum has faced criticism over gas fees in the past, the rollout of Layer2 scaling solutions like Arbitrum, Optimism, and Base has shifted the narrative. These L2s are helping reduce costs while expanding Ethereum’s reach to millions of users. That’s why Ethereum doesn’t just dominate in raw TVL numbers, but also in terms of innovation and developer activity.

Why this matters: Ethereum’s massive TVL shows that institutions, whales, and retail users alike still trust it as the most secure and versatile DeFi ecosystem.

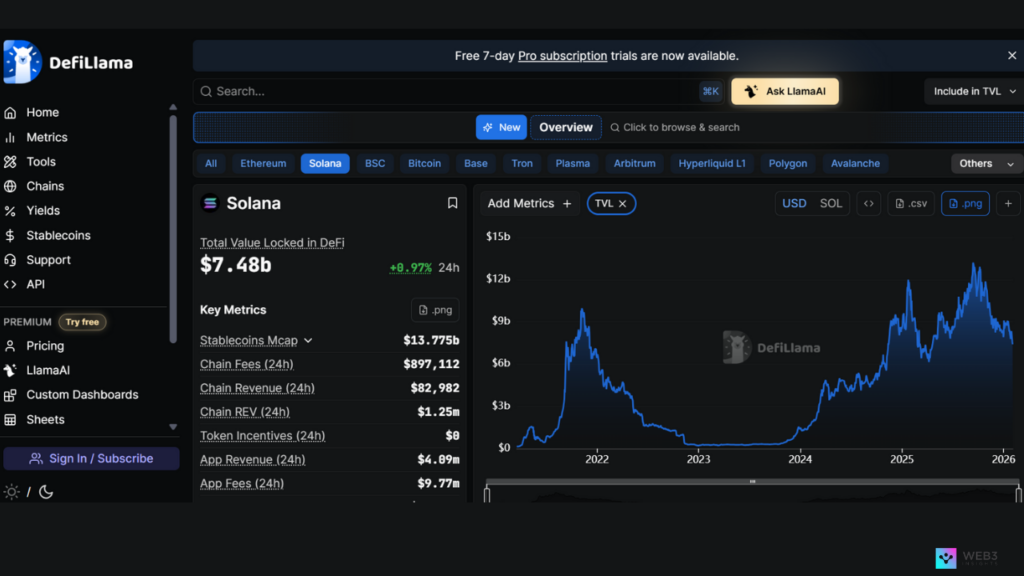

2. Solana (SOL): $7.48B Locked

If Ethereum is the old guard, Solana is the fast-rising challenger. With over $7 billion locked, Solana has carved out a solid second-place position. What sets Solana apart is its blistering transaction speed and extremely low fees, which have attracted both individual users and institutional liquidity.

Protocols like Jupiter (the DEX aggregator), MarginFi, and Marinade Finance are pulling in billions of dollars in deposits. And because Solana provides such a smooth user experience, it’s also become a favorite for retail DeFi traders who want cheaper alternatives to Ethereum.

Why this matters: Solana proves that speed and accessibility are just as important as deep liquidity. Its climb in TVL is a signal that DeFi isn’t just for whales, it’s for everyone.

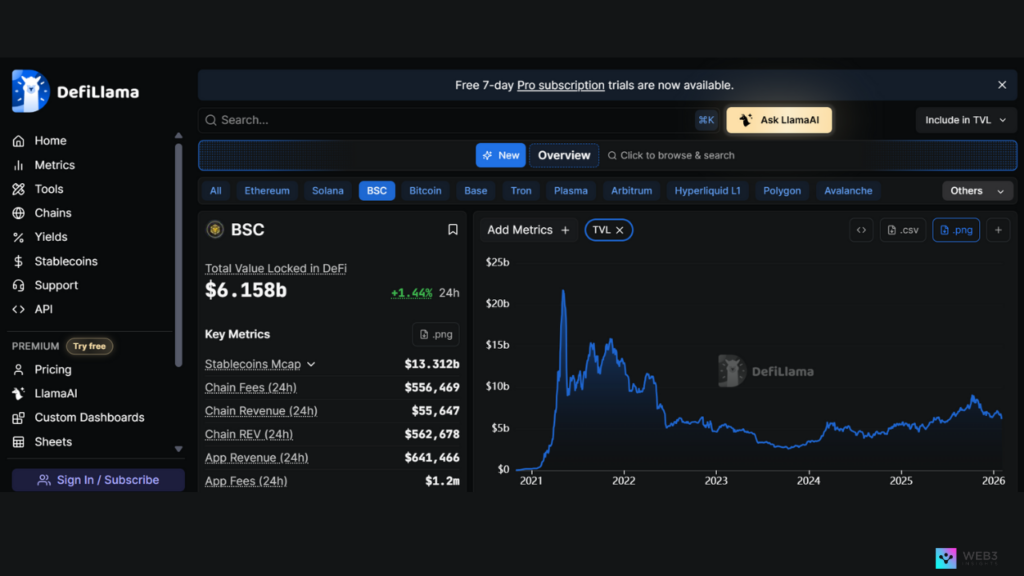

3. Binance Smart Chain (BSC): $6.158B Locked

The Binance Smart Chain (BSC) may not get as much hype as Ethereum or Solana, but it continues to hold strong with $6.158 billion in TVL. BSC thrives on accessibility, it’s easy for beginners to onboard, transaction fees are low, and popular apps like PancakeSwap give retail users straightforward ways to trade, farm, and stake.

Even though critics argue that BSC is more centralized compared to Ethereum, its simplicity has made it one of the most widely used chains for firsttime DeFi users. And as long as Binance remains one of the biggest exchanges in the world, BSC will continue to benefit from that liquidity pipeline.

Why this matters: BSC shows that centralization concerns don’t always stop adoption. What matters most to users is low fees and convenience, and that’s exactly what BSC delivers.

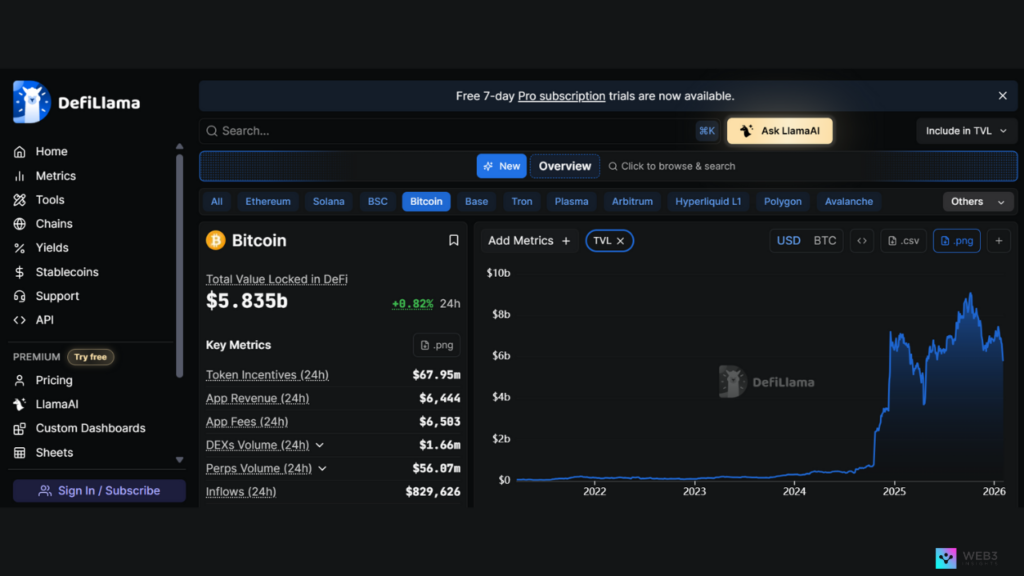

4. Bitcoin (BTC): $5.835B Locked

This one might surprise newcomers: Bitcoin now ranks third in DeFi TVL, with more than $5 billion locked. Historically, Bitcoin wasn’t built for DeFi, it was designed as peer-to-peer money. But through innovations like wrapped Bitcoin (wBTC), Stacks, and Zeus Network, BTC has entered the DeFi arena.

By locking up Bitcoin into DeFi protocols, holders can now use BTC as collateral, lend it out, or generate yield while still keeping exposure to the world’s largest crypto. This shift has turned Bitcoin from a passive “digital gold” into an active, productive asset.

Why this matters: With Bitcoin making its way into DeFi, the largest crypto asset is no longer sitting on the sidelines. Its growing TVL represents a new wave of liquidity flowing into decentralized finance.

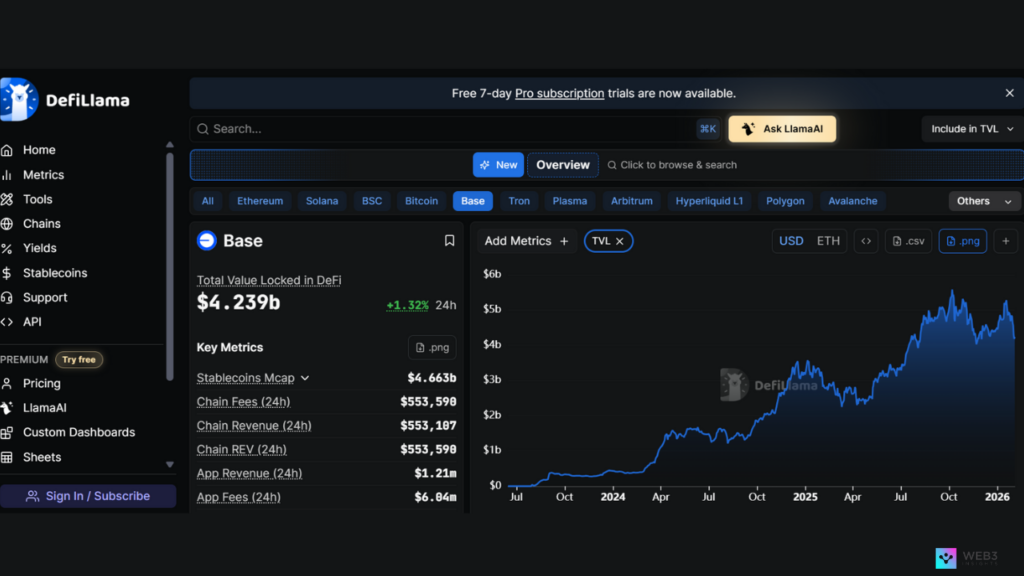

5. Base: $4.239B Locked

Base has emerged as one of the most important DeFi ecosystems in 2026. Built as an Ethereum Layer-2 and backed by Coinbase, Base has rapidly attracted liquidity due to its low fees, strong UX, and deep integration with Ethereum assets.

DeFi protocols on Base including lending platforms, decentralized exchanges, stablecoin liquidity pools, and yield strategies, have seen explosive TVL growth. Many users now deploy capital on Base first before bridging elsewhere, making it a primary destination for DeFi activity rather than just a secondary scaling layer.

Base’s TVL growth is driven by:

- Heavy usage of ETH and stablecoins

- Strong participation from retail and institutional users

- Native support for major DeFi protocols is expanding from Ethereum

In 2026, Base is no longer “emerging”, it is a core DeFi network by TVL.

Why this matters: Base position highlights the importance of stablecoins in DeFi’s growth, especially in developing markets where efficiency and cost matter most.

Conclusion

Looking at TVL in 2026, one thing is clear: altcoins are driving the future of DeFi. Ethereum remains the undisputed leader, Solana is rising fast as a challenger, Bitcoin has broken into the space through innovative integrations, and both BSC and Base continue to serve millions with affordable access to DeFi.

These numbers show us more than just rankings; they reveal where users are actually putting their money and which ecosystems they trust the most. TVL doesn’t capture everything about adoption, but it’s one of the most telling signals of where the momentum is headed.

If you want to understand where DeFi is going next, just follow the liquidity. Right now, these five altcoins are showing us exactly where the action is.