Last month, I was glued to the charts when I noticed something strange. Bitcoin and Ethereum were moving sideways, altcoins felt sluggish, but then I saw billions of dollars in Tether (USDT) suddenly flowing into exchanges. A few days later, Solana and a handful of mid-cap alts went on a massive run.

That’s when it hit me: stablecoins weren’t just sitting quietly in the background. They were moving the market.

Stablecoins might look boring because they don’t moon or crash like other tokens, but if you pay attention to their activity, you can actually predict when altcoins are about to pump. In this post, I’ll show you the three key metrics I track that prove just how important stablecoins are for altcoin liquidity.

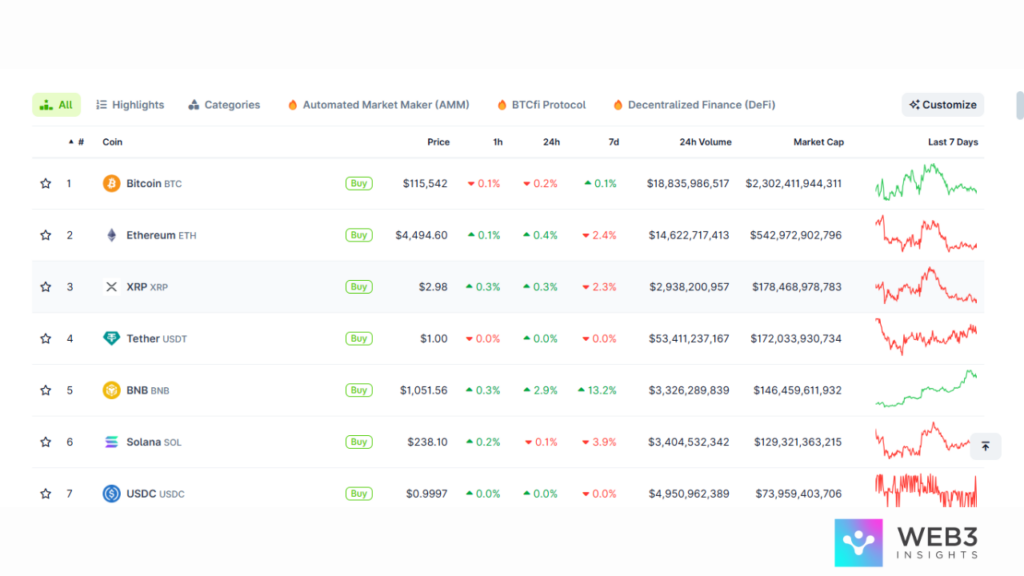

Metric 1: Trading Pairs Dominated by Stablecoins

The first and most obvious metric is the number of trading pairs.

If you’ve ever bought or sold an altcoin, chances are you didn’t trade it directly against the dollar or euro. Instead, you traded it against Tether (USDT), USD Coin (USDC), or another stablecoin.

This is by design. Exchanges, both centralized and decentralized, rely on stablecoins as the default base currency. They’re faster, cheaper, and more global than dealing with actual fiat.

For example, if I want to buy Solana on Binance, I’ll find the SOL/USDT pair instantly. If I want to swap into some smaller alt, I’ll usually route through a stablecoin first.

This is where liquidity comes in. Stablecoins give altcoins a universal “denominator.” Traders from anywhere in the world can pile into or out of positions without worrying about banking rails.

Without stablecoins, altcoin trading would be fragmented, inefficient, and thin. With them, there’s always a deep pool of liquidity to trade against.

Metric 2: Stablecoin Market Cap vs Altcoin Liquidity

Now here’s where things get even more interesting.

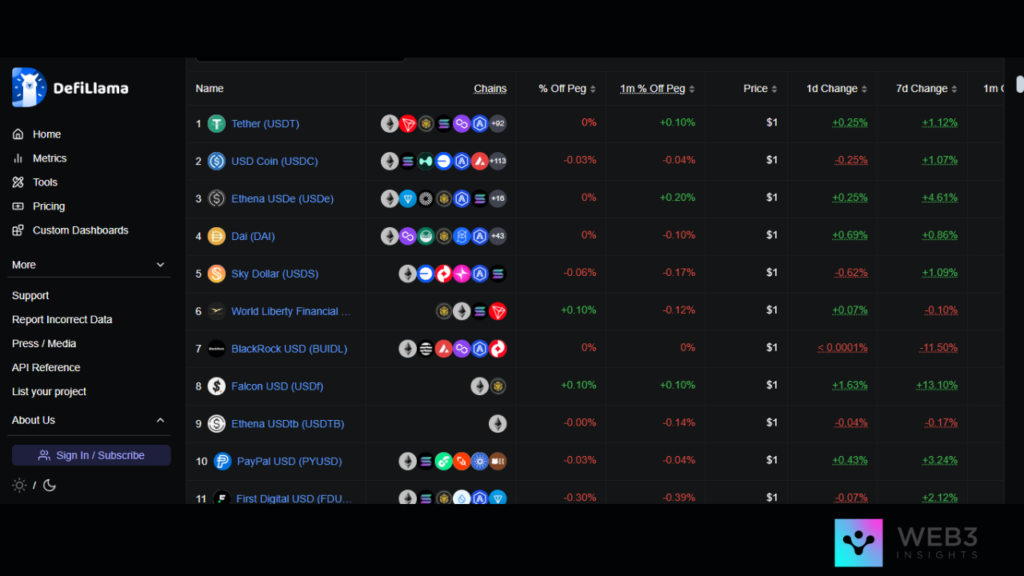

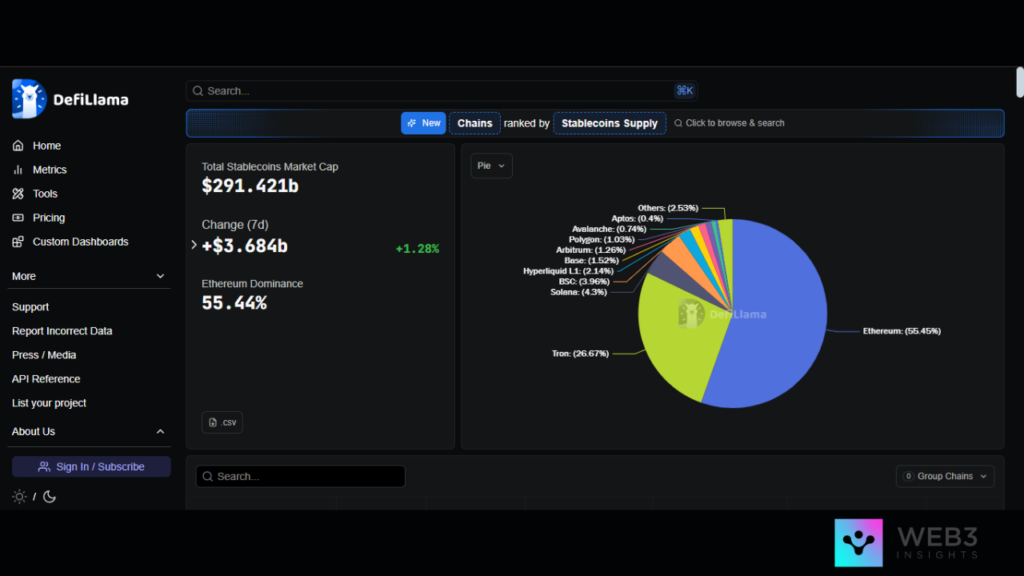

The total supply of stablecoins in circulation often predicts the amount of liquidity available in the altcoin market. Think about it: when the market cap of USDT, USDC, and other stablecoins rises, it means more fresh capital is parked on-chain. And what do traders do with that fresh capital? They buy altcoins.

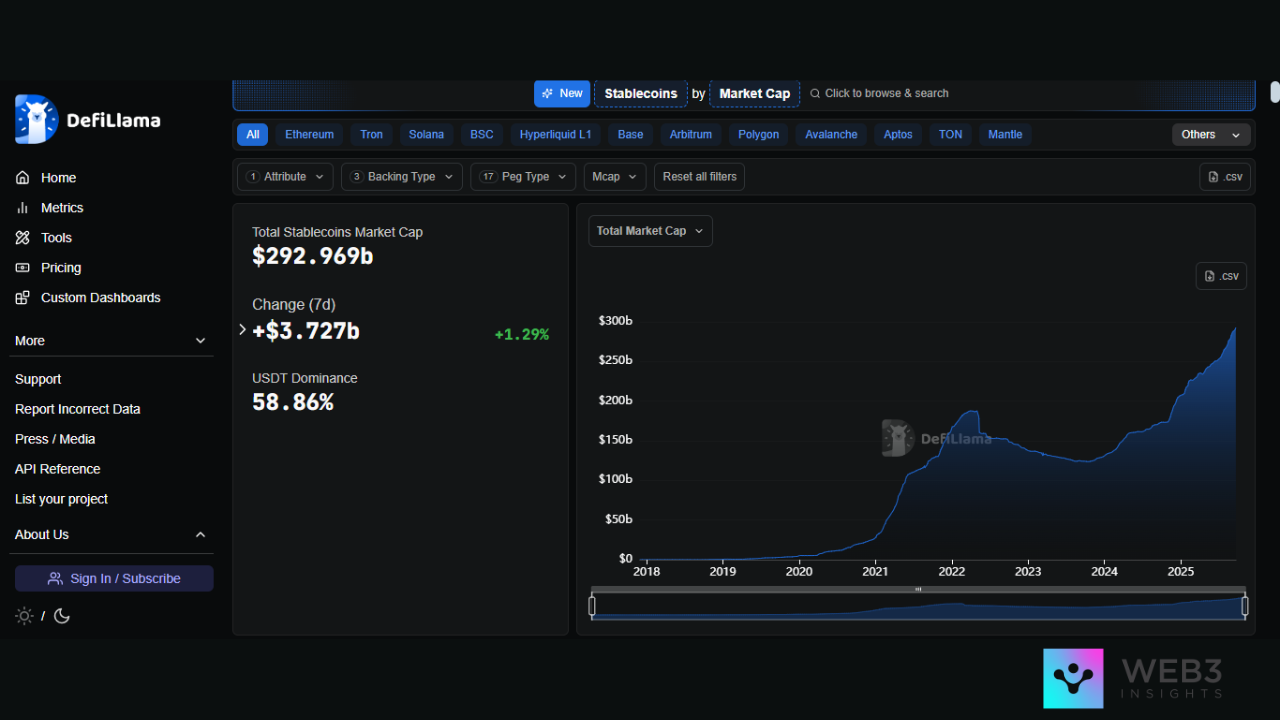

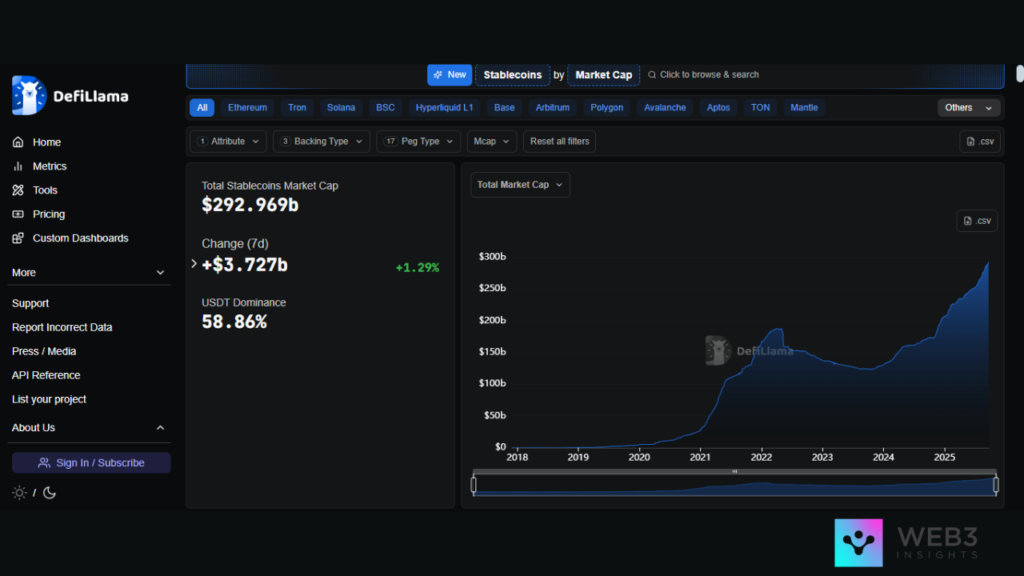

I always watch the stablecoin supply charts on DefiLlama. For example, whenever Tether’s market cap jumps by billions, it usually signals that money is flowing in, ready to chase riskier assets. Within weeks, you’ll often see altcoin volumes pick up and prices rise.

On the flip side, when stablecoin supply contracts, like when USDC’s market cap fell during banking scares, it often drags liquidity out of altcoins. Less stablecoin supply = less trading fuel = weaker alt markets.

Stablecoins, in other words, act as a thermometer for the altcoin ecosystem. When their supply is hot, altcoins pump. When it’s cold, altcoins struggle.

Metric 3: On-Chain Stablecoin Flows

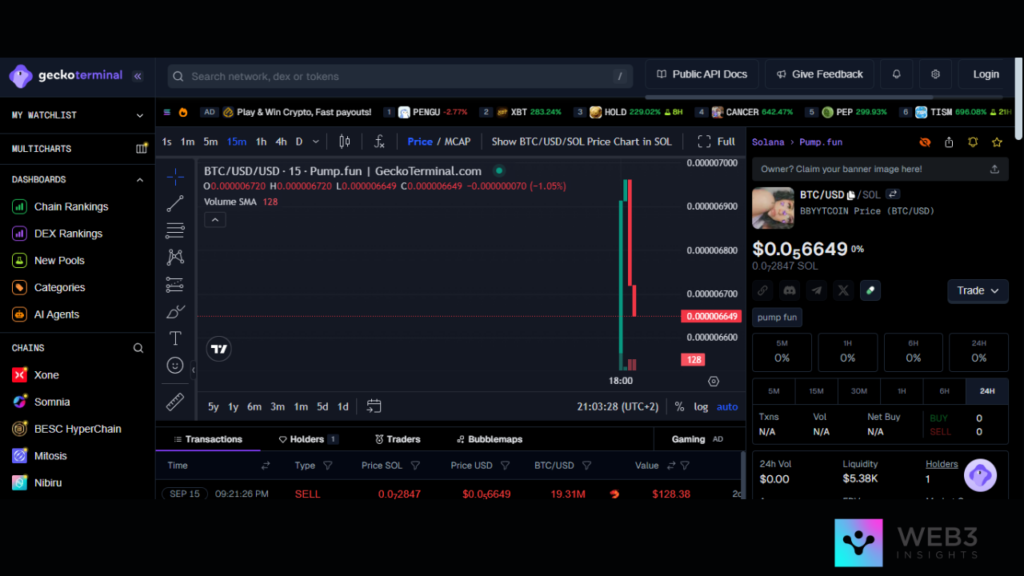

This one is my favorite, because it shows how traders really behave in real time.

It’s not just about the supply of stablecoins. It’s about where they are. Are they sitting in cold wallets? Are they locked in DeFi? Or are they being sent to exchanges, ready to buy altcoins?

That’s where on-chain stablecoin flows come in.

Platforms like Glassnode and CryptoQuant let you see when billions of dollars worth of USDT or USDC are moving onto exchanges. And let me tell you, when that happens, it’s usually a signal that buying pressure is about to hit. Traders don’t just move stablecoins onto Binance or Coinbase for fun, they move them there to make plays.

The opposite is also true. When stablecoins are flowing off exchanges and into DeFi or cold storage, it often means risk appetite is cooling down. Traders are sitting on the sidelines, parking their funds.

I can’t count how many times I’ve seen exchange inflows spike, only to watch altcoins pump shortly after. It’s one of those metrics that really gives you an edge if you’re paying attention.

Why Matters for Altcoins

Put these three metrics together, and the story becomes crystal clear:

- Stablecoins dominate trading pairs → they provide the very rails that altcoins trade on.

- Stablecoin market cap → signals how much “ammo” traders have to move altcoins.

- On-chain flows → show when that ammo is being deployed.

Altcoins don’t exist in a vacuum. They rise and fall on the back of stablecoin liquidity. It doesn’t matter how good the tech or narrative is, if there’s no stablecoin flow, there’s no liquidity. And without liquidity, even the best altcoin will wither.

My Takeaway

I used to think stablecoins were boring, just static coins tied to a dollar. Now I know they’re the pulse of the entire altcoin market.

These days, I don’t even look at an altcoin chart before I check stablecoin metrics. If USDT supply is rising, if USDC is flowing into exchanges, and if stablecoins dominate the pairs, then I know liquidity is alive. That’s when I hunt for altcoins with momentum.

If you want to play this game seriously, don’t ignore the “boring” coins. Watch them like a hawk. Because in crypto, the quiet stablecoins are often the loudest signal.