The world of crypto is changing fast, and one of the exciting new ideas is the Real-World Asset (RWA) tokenization. This means turning real things, like houses, art, or gold, into digital assets that can be traded on the blockchain. As this idea grows, artificial intelligence (AI) is becoming a big part of improving it.

AI can help make tokenizing these real-world assets faster and more accurate. When we mix AI’s power with the blockchain’s transparency, it creates a smarter, easier way to manage and trade these assets.

More and more investors and businesses are looking into how they can tokenize RWAs, and the combination of AI and tokenization is set to change how we think about owning and trading things in the crypto world.

In this article, we’ll break down what RWA tokenization is, how AI helps, and why this combination could be the next big thing in crypto.

Understanding Real World Assets (RWAs) Tokenization

Imagine being able to own a small piece of a luxury apartment, a famous painting, or even a bar of gold, all without needing a ton of cash or dealing with complicated paperwork. That’s the magic of Real-World Asset (RWA) tokenization.

In simple terms, RWA tokenization is all about turning physical assets; things we can touch and see, like real estate, artwork, or commodities into digital tokens that can be traded on the blockchain. These tokens represent ownership in those real assets. For example, instead of buying an entire building, you could own just a small portion by purchasing digital tokens that represent a fraction of its value.

Let’s break it down: say there’s a building worth $1 million. Through tokenization, that building can be split into thousands of tokens, each worth a small share maybe $1,000 per token. You can then buy, sell, or trade these tokens just like you would with any other cryptocurrency or NFT.

Why Tokenizing Real-World Assets is a Big Deal

One of the coolest things about tokenizing real-world assets is that it makes them much more liquid. Normally, if you wanted to sell something like real estate or a piece of fine art, it would take a long time, lots of paperwork, and maybe even some legal headaches. But with tokenization, you can trade these assets quickly on blockchain platforms, just like you would trade stocks or crypto.

It also makes these assets more accessible to everyday people. In the past, only the super-wealthy could invest in things like luxury properties or expensive artworks. With RWA tokenization, even small investors can buy into these assets by owning just a fraction of them. It’s kind of like being able to buy a single slice of a very expensive cake, instead of needing to buy the whole thing.

How AI Enhances RWA Tokenization

Integrating artificial intelligence (AI) with Real-World Asset (RWA) tokenization is changing the game in the crypto world. Here’s how AI is making a big difference:

1. Better Asset Valuation

One of the biggest challenges in tokenizing Real-World Assets (RWAs) is figuring out their true value. For example, how do you know the actual worth of a property or a piece of artwork? This is where AI shines. It can sift through tons of data like market trends, past sales, and even broader economic factors to come up with a more accurate estimate of an asset’s value.

Take real estate tokenization as an example. AI can look at things like property details, the sales history of similar homes in the area, and overall market trends. With all this data, it calculates a fair market value, making sure the token that represents the asset is priced correctly, which reduces the risk of mispricing.

AI-powered algorithms go even further by analyzing massive datasets and spotting patterns that humans might miss. With machine learning, tokenization platforms can offer more flexible pricing based on real-time data. This not only makes pricing more accurate but also helps investors feel more confident about the value of the assets they’re investing in.

2. Asset Digitization and Compliance

Tokenizing real-world assets can be tricky because it involves a lot of legal rules that change depending on the country or region. AI tools help simplify this by automating many of these legal steps and making sure the process follows all the necessary laws. For example, Natural Language Processing (NLP) can quickly read and understand legal documents and smart contracts can automatically handle regulatory requirements on the blockchain.

AI also boosts security by making identity verification more accurate. It checks participants’ identities to prevent fraud. By automating tasks like KYC (Know Your Customer) and AML (Anti-Money Laundering), AI makes it faster and easier to onboard investors while still following the rules.

3. Due Diligence: Fraud Detection

Before an asset can be tokenized, verifying everything is above board is essential. AI is great at handling due diligence and ensuring the asset is authentic, properly documented, and compliant with regulations.

AI systems can scan through large databases to check ownership records, and legal documents, and even spot fraud. For example, if someone wants to tokenize an artwork, AI can verify its ownership history and ensure it’s genuine. This helps both buyers and sellers trust that everything is legitimate.

4. Democratized Access to Investment Opportunities

One of the best things about using AI in RWA tokenization is that it makes investing more accessible to everyone. By breaking down ownership into smaller, affordable pieces, tokenization allows more people to invest in things like real estate, art, and private equity markets that used to be hard to get into.

AI also helps by offering personalized investment options. It looks at your preferences, risk level, and financial goals to recommend the right investments, making it easier to build a diverse portfolio. Plus, AI analyzes patterns in transactions and investor behaviour to help improve asset allocation and boost returns, making it easier for more people to grow their wealth.

5. Enhanced Liquidity and Market Efficiency

Traditional markets for real-world assets, like real estate or art, often face problems like slow transactions and limited trading hours, making it hard to buy or sell quickly. AI is helping solve these issues by offering round-the-clock market-making services. This means AI can match buyers and sellers in real-time, speeding up trades and making the whole process smoother.

AI also uses predictive analytics to forecast market trends, predict changes in supply and demand, and even find price differences for quick gains (arbitrage). This makes the market more efficient and less volatile, so tokenized assets become easier to trade and attract more investors, which helps boost secondary market activity.

By combining AI with blockchain, the way we tokenize and trade real-world assets is changing dramatically. AI brings more efficiency, transparency, and accessibility to the process, revolutionizing how we invest in tangible assets. As these technologies grow, they have the potential to reshape the financial world, opening up a new era for digital and decentralized assets.

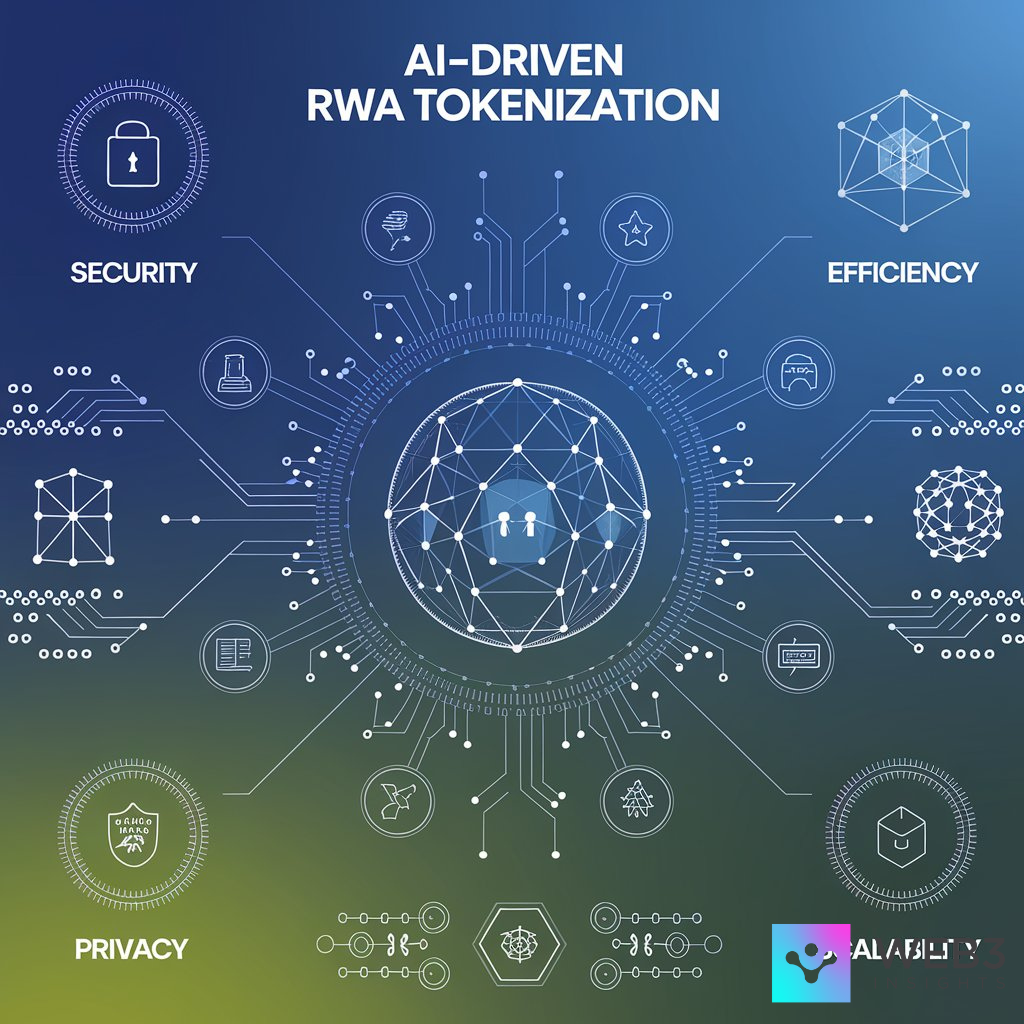

The Benefits of AI-Driven RWA Tokenization

AI’s powerful abilities are changing industries everywhere, making it a must-have tool for RWA services. Its benefits show up in a few key areas:

1. Enhancing Security

AI is a game-changer for cybersecurity, especially in tracking transactions for anything unusual that might signal a threat. It can catch patterns or odd behaviour that humans might miss, like early signs of fraud or a cyber-attack.

When AI spots something suspicious, it can take action right away, blocking risky transactions or isolating systems to prevent more damage. This smart, proactive approach helps keep RWA services safe and reliable.

2. Enhancing Efficiency

One of the biggest benefits of AI in RWA tokenization is the improved efficiency it provides. Tokenizing real-world assets involves complex processes, from verifying asset ownership and value to ensuring compliance with regulatory standards. AI can automate these traditionally time-consuming tasks, significantly speeding up the process.

3. Strengthening User Privacy

Privacy is a big concern in RWA transactions. AI helps protect privacy by using advanced encryption that’s tough for hackers to crack. It also improves identity verification through methods like facial recognition or fingerprints, making the process more secure without being too invasive. These AI tools keep user data safe and confidential, lowering the risk of data breaches and identity theft.

4. Scalability for Global Markets

As more assets are tokenized, managing a growing portfolio of RWAs across multiple jurisdictions can become overwhelming. AI solves this by offering scalable solutions that can handle large amounts of data and automate the management of numerous assets.

Through AI, investors and platforms can efficiently manage everything from portfolio diversification to tracking cross-border tokenization of assets. AI-powered systems allow for the seamless tokenization of large volumes of assets, which would be far more difficult to handle manually.

Conclusion

The combination of AI in crypto and RWA tokenization is changing the digital asset landscape. AI helps make the tokenization of real-world assets more efficient and accessible. This means better risk assessments, enhanced security, and improved market predictions, allowing investors to make smarter choices.

Looking to the future, the impact of AI and RWA tokenization on the crypto community is bright. These technologies can make investments more accessible, promote transparency, and increase liquidity. Ultimately, as they develop, they will reshape how we invest, benefiting both individual investors and institutions. The future promises a more inclusive and efficient financial world for everyone.