Imagine owning a piece of real estate or a luxury car, but instead of going through mountains of paperwork, you simply hold a digital token that proves your ownership. Sounds futuristic. That’s exactly where we’re headed, thanks to the powerful collaboration between Real-World Assets (RWAs) and Non-Fungible Tokens (NFTs).

What if we could tokenize real-world assets using NFTs, making them easier to trade, own, and manage? This exciting blend is opening up a whole new world of possibilities.

In this article, we’ll dive into how RWAs and NFTs are coming together to revolutionize industries, from real estate to fine art, offering new ways to invest and interact with physical assets in a digital world. Let’s explore how this collaboration could change the way we think about ownership and value.

What are Real-World Assets (RWAs)?

Think about the kinds of assets that hold value in the real world. Things like real estate, gold, artwork, and even intellectual property like patents or music rights. These are called Real-World Assets (RWAs).

They’re valuable, but owning or trading them isn’t always easy. For example, buying a house takes time, a lot of paperwork, and often involves real estate agents, lawyers, and banks. The same goes for things like fine art or gold, which need secure storage, and authentication, and aren’t always easy to sell quickly.

In short, RWAs are essential parts of the economy but often come with high barriers to entry, complex ownership processes, and limited liquidity. That means it’s not as easy for everyday investors to get involved. However, with the rise of blockchain technology, there’s a new way to deal with these assets, making them more accessible to a broader audience. And that’s where NFTs come in.

What are Non-Fungible Tokens (NFTs)?

NFTs are unique digital assets stored on the blockchain. Unlike cryptocurrencies like Bitcoin, where each unit is identical to another, NFTs are one-of-a-kind. Each NFT represents ownership of something specific whether that’s a digital file like a piece of art, a video clip, or even a physical asset like a house or luxury item.

The exciting thing about NFTs is that they make it easy to verify ownership and transfer rights in a secure, transparent way. You can think of them as digital certificates of authenticity or ownership that are impossible to fake.

Synergy Between RWAs and NFTs

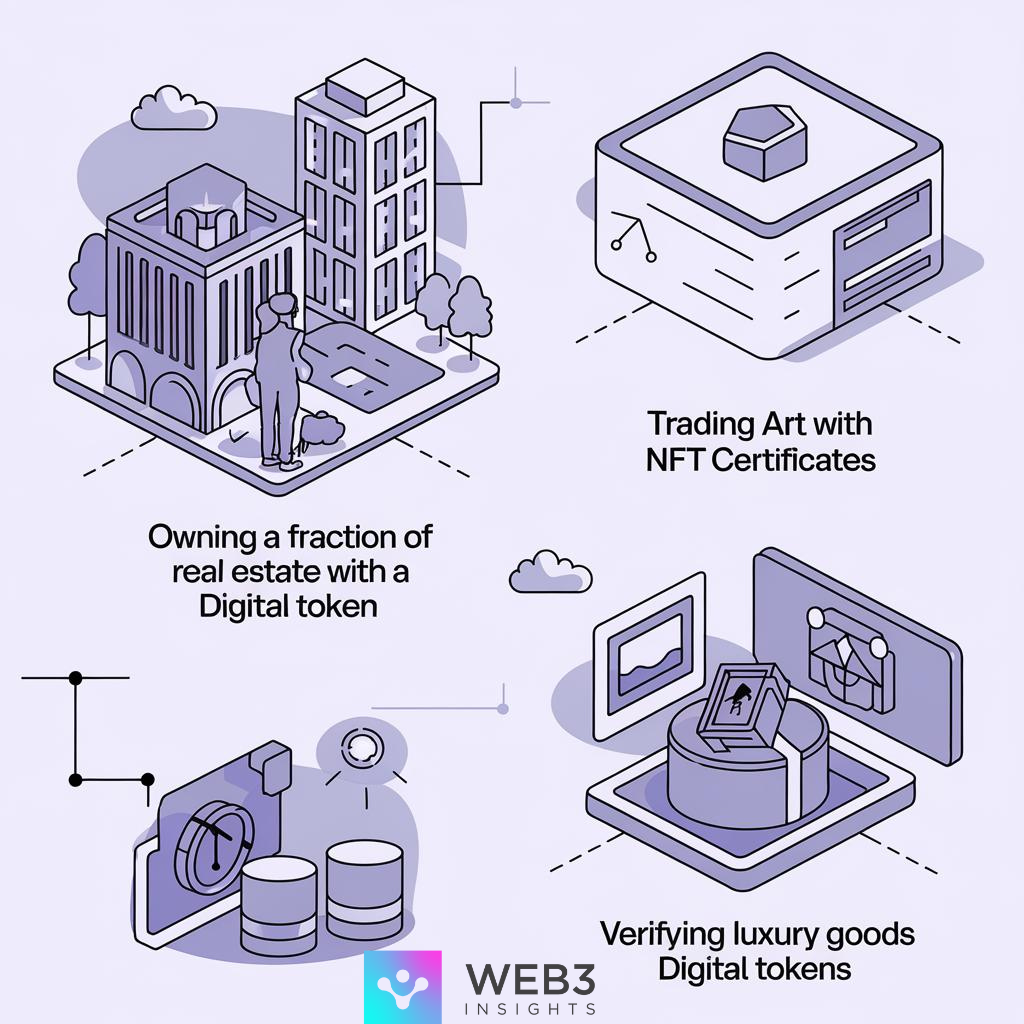

Now, this is where it gets really interesting. When you combine the world of RWAs with the technology of NFTs, you unlock a whole new level of possibilities. Imagine owning a fraction of a high-end real estate property, or even a piece of fine art, by purchasing an NFT that represents a share in that asset. Suddenly, assets that were once difficult to access or trade become more liquid and open to a global audience.

Tokenizing RWAs using NFTs can solve many of the traditional challenges associated with these assets, making them easier to trade, allowing for fractional ownership, or enhancing transparency in transactions. This synergy creates a powerful collaboration that can reshape markets and offer real-world value in a digital-first world.

Use Cases of RWAs and NFTs Collaboration

When you bring together RWAs (Real-World Assets) and NFTs (Non-Fungible Tokens), the possibilities start to get exciting. By tokenizing physical assets, we open the door to new ways of owning, trading, and accessing items that, in the past, were reserved for only a few.

Let’s explore some of the most interesting ways this collaboration is already making waves.

1. Real Estate

Imagine owning a piece of prime real estate without needing millions of dollars upfront. That’s what happens when real estate is tokenized using NFTs. Instead of one person owning an entire property, it’s divided into smaller, tokenized shares. So, you could own a fraction of an apartment building, even if you’re just investing a small amount.

These tokens, represented by NFTs, make it easier to buy, sell, or trade real estate shares in a much faster and more transparent way than the traditional process. Plus, because everything is tracked on the blockchain, there’s no confusion about ownership, and transactions happen without needing middlemen to slow things down.

2. Art and Collectibles

The art world is no stranger to NFTs, especially with digital art making headlines. But when it comes to physical art, NFTs can make just as big of an impact. Think of an NFT as a digital certificate that proves your ownership and the authenticity of a piece of art. This makes it easier to buy and sell valuable works because you don’t need a bunch of paperwork or experts verifying things.

You can simply look at the NFT tied to the artwork, and everything is clear. Imagine owning a famous painting but only needing to trade the NFT to transfer ownership, the painting stays safely in place, but you can still sell or buy it without all the hassle.

3. Luxury Goods

Ever wondered how luxury brands are tackling counterfeiting? NFTs offer an elegant solution. When you buy a luxury watch or designer handbag, for instance, you could also receive an NFT that verifies its authenticity.

This digital record proves where the item came from, who’s owned it, and that it’s the real deal. If you decide to sell that watch later, the NFT goes along with it, making resale easier and more trustworthy. And because the blockchain is public and secure, the entire history of that luxury item is easily accessible and impossible to alter.

4. Commodities and Precious Metals

When we talk about commodities like gold, silver, or even oil, it’s easy to think of them as things only large institutions can trade. But NFTs are changing that. Let’s say you want to invest in gold but don’t want to deal with storing or transporting it. With tokenization, a gold bar can be broken down into digital shares, and you can own a fraction of it via an NFT.

You’d be able to trade your share just as easily as you would any other digital asset, without ever having to see the gold itself. This opens up new opportunities for smaller investors to get into markets that were previously out of reach.

5. Intellectual Property

NFTs are also making waves in the world of intellectual property (IP). Whether it’s patents, trademarks, or even music rights, NFTs can represent ownership in these areas, making it easier to manage and transfer them. Imagine a musician tokenizing the rights to their songs.

Fans or investors could then buy NFTs representing a portion of future royalties. Not only does this provide the artist with an upfront revenue stream, but it also makes royalty ownership transparent and secure. It’s a win-win for creators and investors alike.

Conclusion

The combination of Real-World Assets (RWAs) and Non-Fungible Tokens (NFTs) is opening up exciting new possibilities. By turning physical assets into NFTs, we can make it easier for people to own, trade, and invest in things like real estate, art, and commodities. This approach makes traditionally hard-to-trade assets more liquid and accessible to a global audience.

While there are still challenges such as legal regulations and market risks the potential benefits are huge. RWAs and NFTs together could change how we think about ownership and investment, bringing more transparency, security, and efficiency to these processes. This partnership has the power to shape the future of how we interact with both digital and physical assets.